Parisian real estate, a two-speed market

The state of the Parisian real estate market by Sébastien Kuperfis, President of Junot. Maison Junot shares its back-to-school analysis with you.

Maintaining the number of transactions

Our observations from the first half of 2023 confirm the trend of a two-speed market. On the one hand, the volume of transactions carried out by Junot is holding steady with sales deadlines equal to 2022. The behavior of the players remains wait-and-see; buyers are more demanding, looking for turnkey properties, penalizing significant defects with the price. On the seller side, most are showing greater realism, which is making transactions smoother. As a result, prices are falling by 7.5% on average vs. 2022, out of the 400 sales made since the beginning of the year.

Resistance of zero defect goods

Perfection continues to sell at a high price; at Junot, this is reflected in the resilience of prices. In arrondissements and districts considered to be safe havens - this is particularly the case in the west of Paris - family flats are in short supply. These highly sought-after properties, which are impeccably finished, located on a high floor, have an outside area and are close to good schools, are therefore selling quickly, without being discounted.

For example, this 102 m² flat with an exceptional view over the garden of the Archives nationales was bought in less than 24 hours at €21,568 per m² by a Parisian client looking for a Haussmann-style property with an unobstructed view. Or this renovated 117 m² flat on the 5th floor with lift, close to the Champ de Mars, with all the features of a Haussmann-style property and a large balcony with uninterrupted views, sold in 48 hours at €20,293 per m².

It is the outdoor spaces that are driving up prices, with a 59% premium over a flat without one. For flats with exceptional views, the additional selling price is 27% on average.

Junot customers, little impacted by the tightening of financing conditions

The tightening of loan conditions has little impact on demand and sales volumes, due to the scarcity, the quality of the properties offered and the relative "immunity" of buyers in the face of these financing problems: 61% of our customers buy without a loan condition precedent.

Furnished properties are more favored in the first half of 2023, given the tax interest they generate. It is also a solution favored by companies for the housing of their employees. Last year, 43% of rentals were dedicated to companies, listed companies and mobility services of large groups with which we maintain a privileged partnership for the housing of their expatriate employees.

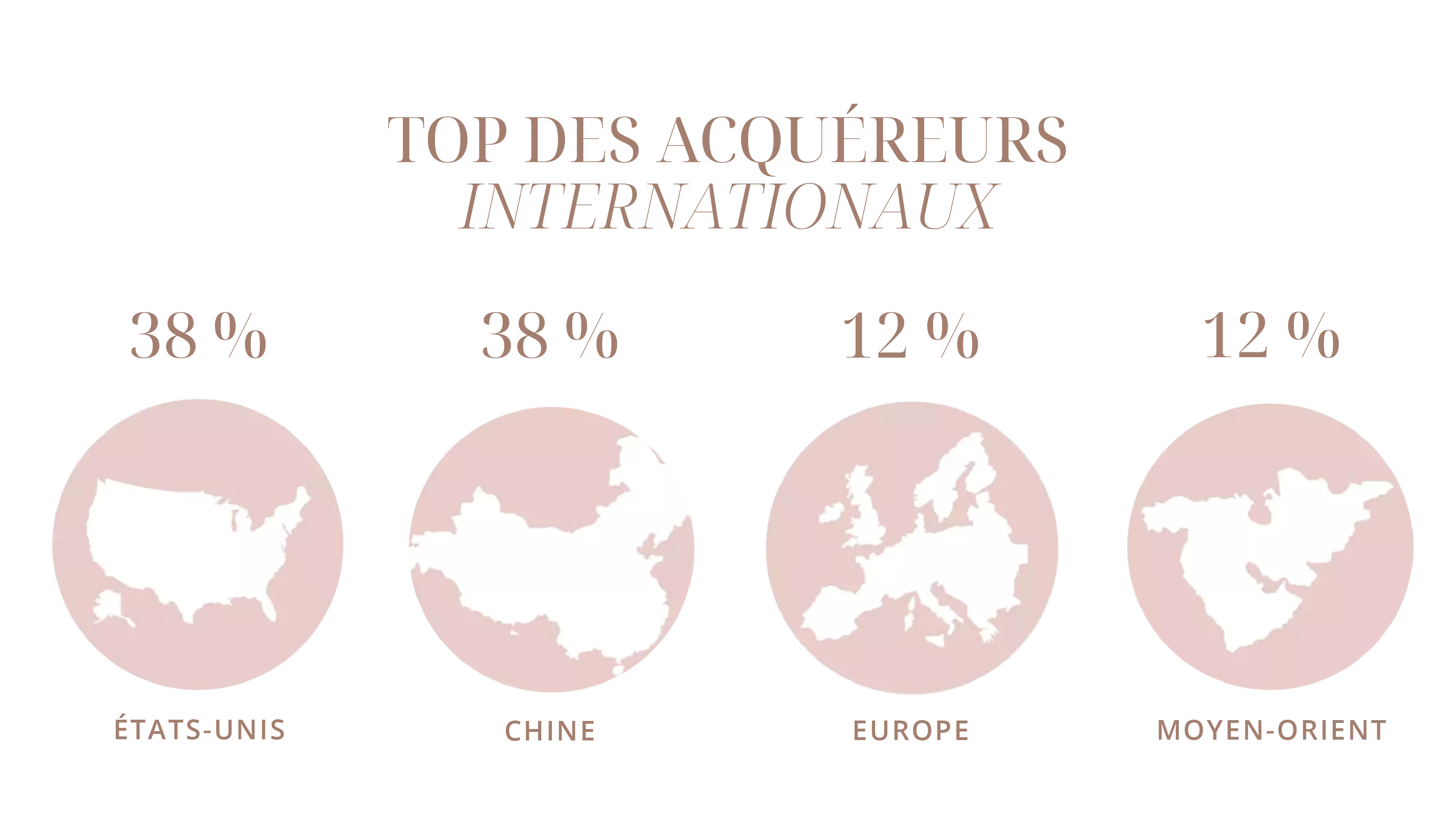

Paris, destination of choice for foreigners

The presence of foreign buyers has been significant at Junot since the start of the year; one in six buyers is foreign for certain types of property and neighborhoods ( 6th , 7th , 8th , 16th ). Paris is today considered the benchmark city in Europe. The capital has many assets, starting with the quality of its historic architecture. Carefully preserved, it attracts a foreign clientele looking for “trophy” apartments or pied-à-terre.

Investing in Paris thus takes on an emotional aspect, similar to that one experiences when purchasing a work of art. Added to this is indisputable financial security, France being much less exposed than Anglo-Saxon or Northern European countries to sudden market variations. As a result, foreign buyers, particularly American and Chinese, have been very present in recent months.

Make an appointment to estimate my property