2025: A new lease of life for real estate thanks to falling rates

With our partner Artemis Courtage, we reveal our analysis of the evolution of current mortgage rates and the impact of these developments on the real estate market.

Favorable conditions for buyers

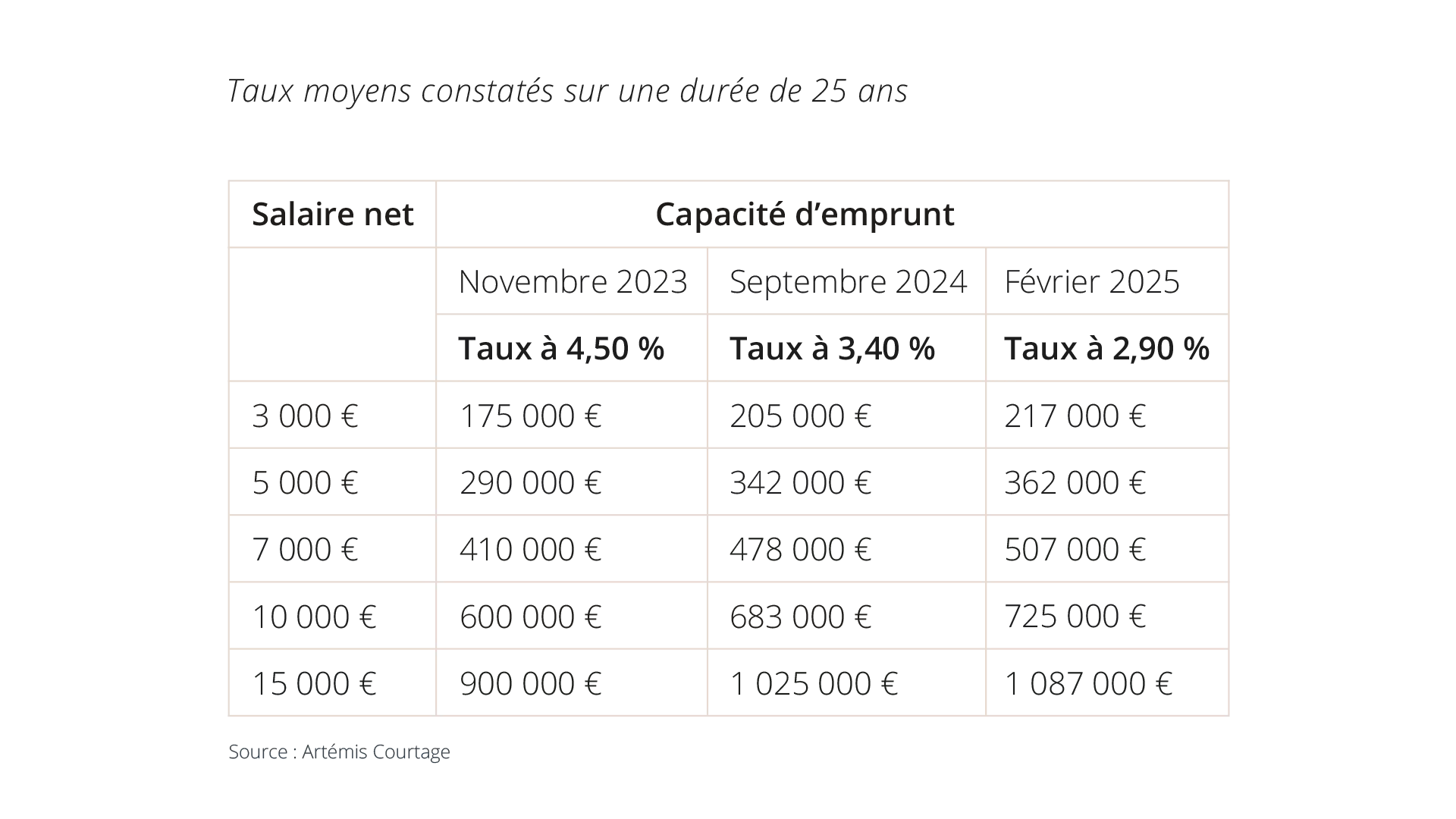

Since the second half of 2024, interest rates have been falling, prompting banks to adopt a more attractive policy to boost real estate lending. At the end of 2023, the average 25-year rate reached 4.47% before falling to 3.38% in December, then to 2.90% in February 2025. This gradual decline is restoring purchasing power to borrowers and reviving a real estate market that had previously been hampered by less favorable conditions. Since February 2025, with a rate stabilized at 2.90%, their financing capacity has improved.

Although borrowing capacity has improved, it still remains 20% below its level in January 2022, when rates reached a historic low of 1%. However, some experts at Artemis anticipate a return to below 2.5 to 3% by the end of 2025, driven by increasingly competitive banking offers aimed at attracting new customers. If this trend continues, 2025 could mark a new era of more flexible financing, offering buyers even more advantageous conditions and strengthening the attractiveness of the real estate market.

2025, A new lease of life for real estate thanks to falling rates

At Junot, the start of the year was driven by strong momentum. Cumulative sales commitments outstanding at the end of February 2025 were 63% up on the previous year.

The market The real estate market is experiencing a resurgence in dynamism, driven by the strong return of buyers. At Junot, the number of new buyers has doubled in one year, reflecting renewed confidence thanks to rock-bottom rates and a gradual recovery in the market, which is becoming more balanced. Today, first-time buyers and buyers of properties classified between A and C in terms of energy performance are particularly advantaged. Paris is also attracting strong demand from American buyers, attracted by the attractiveness of the capital and a euro/dollar exchange rate particularly favorable to investment.